Depreciation days calculation

Depreciation calculations determine the portion of an assets cost that can be deducted in a given year. Block of assets is a group of assets falling within a.

Depreciation Formula Examples With Excel Template

Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet and is charged as an expenditure to a profit and loss account.

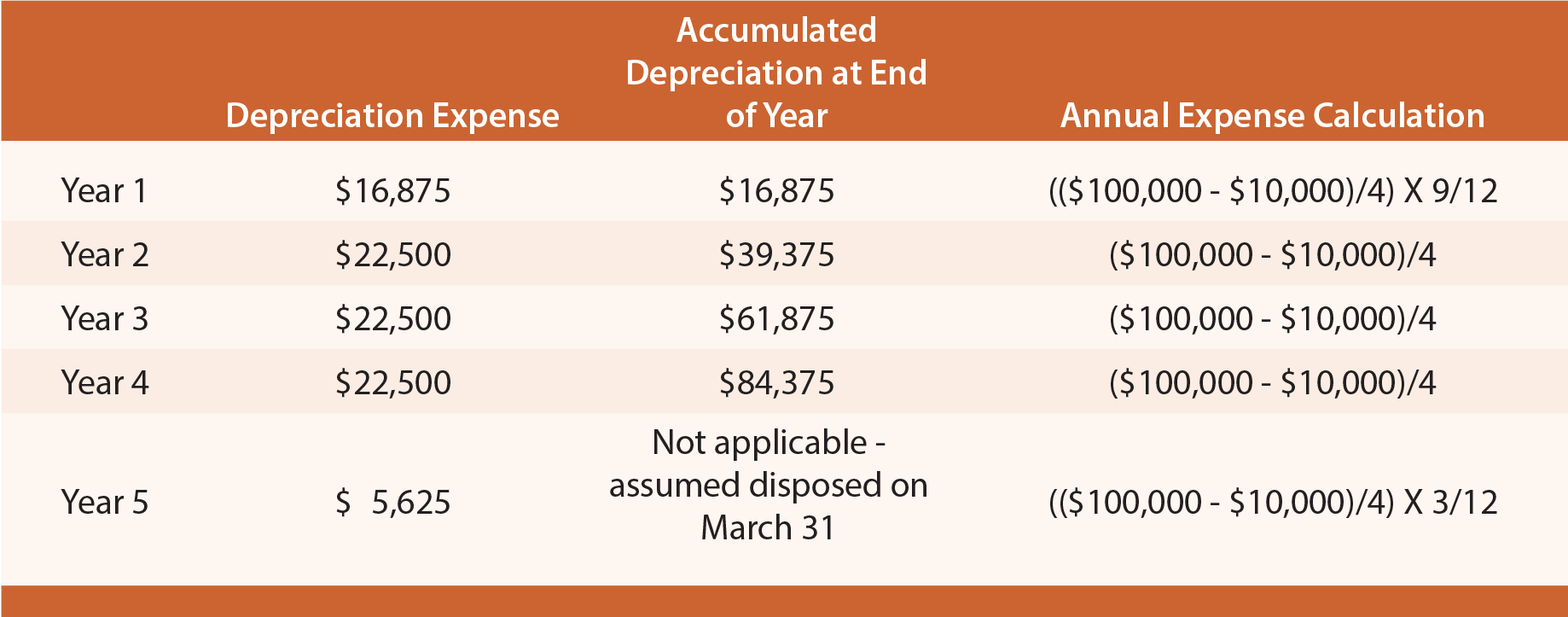

. First year depreciation M 12 Cost - Salvage Life Last year depreciation 12 - M 12 Cost - Salvage Life And a life for example of 7 years will be depreciated across 8 years. Depreciation is allowed on block of assets. Ie Asset put to use on or before.

Excel has the DB function to calculate the depreciation of an asset on the fixed-declining balance basis for a specified period. Depreciation is handled differently for accounting and tax. Depreciation Amount Book value - Salvage Value x Number of Depreciation Days Remaining Depreciation Days Remaining depreciation days are calculated as the.

Depending on the method used the amount may be the same every. Set Depreciation to the day indicator to allow system to calculate the depreciation according to the number of days the asset is used. FA Depreciation Calculation with FA Block and Additional Depreciation FA Block.

The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. Managers Depreciation Calculation Worksheet currently calculates depreciation using the declining balance method.

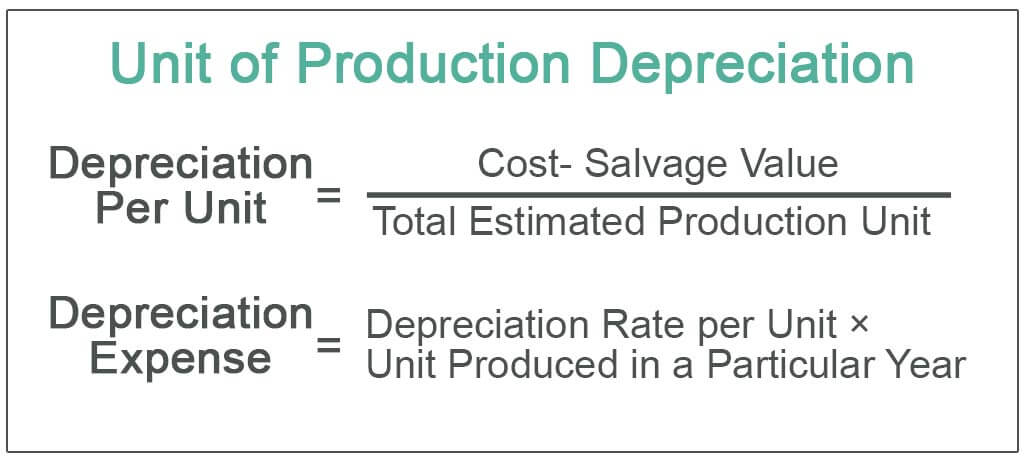

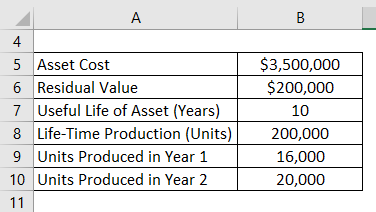

Therefore the calculation of Depreciation Amount using Straight-line Method will be as follows Using Straight-line Method Cost of Asset- Salvage Value Useful Life of Asset 15000. The depreciation calculation is based on the below factors. Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase.

No of days from 20 sept to 31 March is more than 180 Hence full depreciation at 10 Dep on Furniture 50000010 50000 Q2 Furniture Purchased for 500000 on 20. The calculation formula is. The depreciation rate 15 02 20.

The syntax is SYD cost salvage life per with per defined as. The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life. The function needs the initial and salvage costs.

Depreciation is calculated as a percentage of book value based on. Annual depreciation amount Original cost of asset - Salvage valuenumber of periods. Days 100 x 360 Fixed Yearly Amount If you enter a fixed yearly amount the program uses.

Depreciation Amount Straight-Line x Depreciable Basis x Number of Depr. If this indicator is set period. Depreciation Base Value Period Factor Percentage where Period Factor Days to be depreciated in the Year.

An asset has original cost of 1000 and salvage value of. If asset is put to use for less than 180 days then amount equal to 50 of the amount calculated using normal depreciating rates is allowed as depreciation.

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Depreciation Loan Amortization Schedules Depreciation Etsy Canada In 2022 Amortization Schedule Company Financials Financial Business Plan

Depreciation Calculation For Table And Calculated Methods Oracle Assets Help

Depreciation Schedule Formula And Calculator Excel Template

Unit Of Production Depreciation Method Formula Examples

Depreciation Change In Useful Life Youtube

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Methods Principlesofaccounting Com

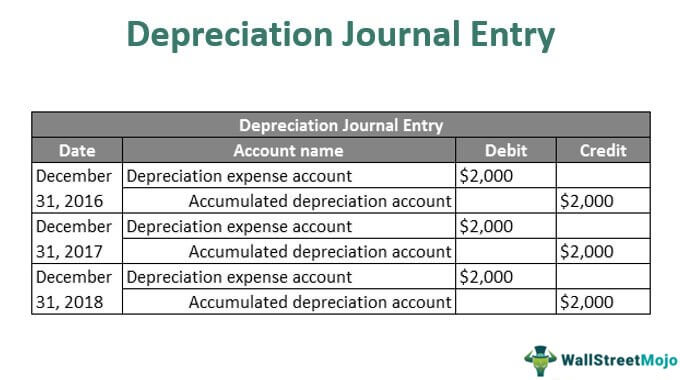

Depreciation Journal Entry Step By Step Examples

Depreciation Calculation For Table And Calculated Methods Oracle Assets Help

Financial Accounting Depreciation Calculation Fixed Assets Sponsored Fixed Asset Financial Accounting Udemy Coupon

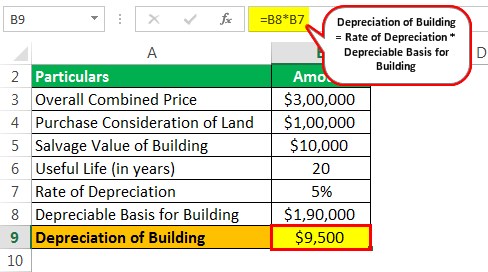

Depreciation Of Building Definition Examples How To Calculate

Depreciation Calculation For Table And Calculated Methods Oracle Assets Help